The IRS has pushed Tax Day 2020 to July 15th in light of the coronavirus outbreak. This delay now applies to both filing federal returns and federal tax payments, and many states are following suit and extending their tax deadline too.

July 15th might seem like a long time away, but experts are still recommending that you file as soon as possible. Hopefully you’ve already gathered your documents and have decided whether it’s a good idea for you to do your own taxes. Now, you might also might want to start figuring out where you’re going to file this year.

How you choose to file will depend on your particular tax situation. For instance, if you are a full-time employee and only have one W-2 to deal with, the process will likely be more straightforward and you can probably save a lot of money by filing yourself online.

If you are a freelancer, juggle a full-time job and a freelance hustle, or own your own business, filing online could also be a good option, though again, it will depend on your specific circumstances.

This said, many online tax sites offer tiered services with low-cost options for any situation. Which is great news. After all, the more money you save on your taxes, the more you’ll be able to put toward your other financial goals for the year.

Thankfully, given it’s the 21st century, there are plenty of different online services to choose from. From TurboTax to Credit Karma Tax, ahead are eight great, free, or cheap options. And it’s easy to get started, so why wait? Get the ball rolling so you can secure your refund.

;)

TaxHawk

Through TaxHawk, you can file a free federal tax return and file state returns for $14.99 each. Federal returns are always free, even if they’re not simple returns. Its low prices for federal and state returns are similar to the other tax tools we’ve recommended here, but its extra features are also very affordable. For $6.99 you can get priority support if you have any questions, file unlimited amended returns, and also get help if you’re audited. For $24.99, you receive personalized tax advice from a tax expert over the phone and a step-by-step walkthrough of TaxHawk’s online filing system through screen sharing.

;)

ezTaxReturn

ezTaxReturn offers a free federal return if your adjusted gross income is $69,999 or less and your taxes are simple — that means that your filing status is either single or married filing jointly, you don’t claim dependents, you received a W-2 for your income (you’re not self-employed, for example), and you’re not claiming the Earned Income Tax Credit, among a few other criteria.

ezTaxReturn makes filling out your federal return easy by asking you a series of easy-to-understand questions. State tax returns, however, are $19.95 each.

;)

FreeTaxUSA

FreeTaxUSA allows you to file federal returns for free, even if your taxes aren’t that straightforward. If you’re filing jointly, itemizing your deductions, or are self-employed, you can still file your federal return at no cost.

There is a cost when it comes to state returns, but it’s a fairly affordable $12.95 per state. They also offer a “deluxe” edition for $6.99, which gives you prioritized access to FreeTaxUSA support, unlimited amendments in case you need to correct your return, and assistance if you’re audited.

;)

Credit Karma Tax

File for free — no matter what — using Credit Karma Tax. They also offer free Audit Defense in case you get audited, and have an easy-to-use, intuitive platform.They’re rated an average of 4.7 out of 5 stars across more than 400,000 reviews.

;)

TurboTax

File your federal and state income-tax returns online at TurboTax for free if you are filing with a W-2, claiming a standard deduction, or more.Check online to see specific requirements and find out whether you qualify, and read reviews from past users here.

;)

TaxAct

TaxAct lets you file your federal and state taxes online, with tiered pricing ranging from $0 to $39.95, depending on your situation.

They also offer free account support and a $100,000 accuracy guarantee — meaning if they make a mistake, you’re covered.

;)

IRS Free File

Using Free File on the IRS website, you can prepare and file your federal and state individual income-tax return for free.

Note that there is easy-to-use software for incomes below $66,000, but above this threshold, you must know how to do your taxes yourself and state tax prep is not available.

;)

TaxSlayer

TaxSlayer helps you file both federal and state taxes online, with tiered prices depending on your unique tax situation.

Check out the reviews from previous customers.

;)

H&R Block

H&R Block offers a few options for online filing, in addition to their in-office drop-off services.

From free filing — which is best for those with W-2s — to deluxe online, which is great for homeowners, there are free or cheap options for anyone, with services for state taxes, as well.

Like what you see? How about some more R29 goodness, right here?

Every Question You Have About Your Taxes, Answered

More Stories

Best Carry-On Luggage: Your Ultimate Travel Companion

How the P10 Mask Enhances Your CPAP Experience

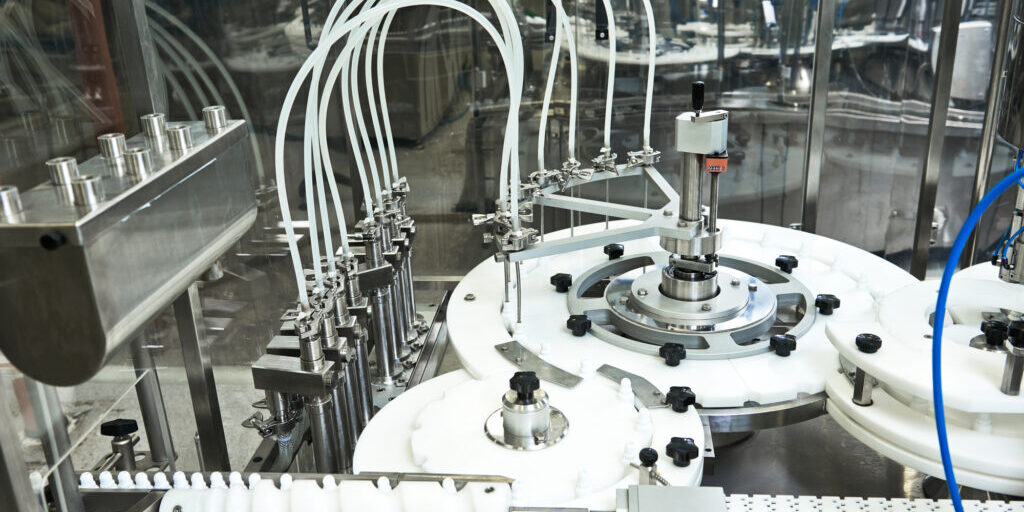

Evaluating the Efficiency of Different Liquid Filling Machine Manufacturers