Text size

Tesla sells insurance and solar panels, as well as cars and autonomous-driving software.

Justin Sullivan/Getty Images

A second broker has taken a shot at valuing Tesla’s software business. The conclusion, good news for the company and for other car makers, is that

Tesla

software is worth a lot.

UBS analyst Patrick Hummel took a look at some of the value hidden away in Tesla (ticker: TSLA). The idea that some might still be undiscovered within the world’s most valuable auto maker, whose stock has trounced the competition, might seem oxymoronic. But bulls believe Tesla is more than just a car company, given that it sells solar panels, insurance, and importantly, software.

Hummell isn’t a full Tesla bull. He rates shares at Hold and has a target of $730 for the share price. He believes other auto makers will have some success ramping up sales volumes for EVs, but that “Tesla remains the undisputed tech leader, most notably in software.”

At his price target. well above the stock’s current level of about $686, Tesla would be worth roughly $700 billion. He values the car business at roughly $200 billion, leaving about $500 billion for everything else.

“The lion’s share of this value can be generated by software, mainly autonomous driving,” wrote Hummell in a Wednesday report. “Out of $20 [billion operating profit] we expect Tesla to generate in 2025, $9 [billion] should already be software-driven.”

That almost half of profit would come from software by 2025 is surprising. Most of that would be from Tesla’s autonomous-driving package, called full self-driving mode, which sells for $10,000 today. To make more money, Tesla could improve the rate at which consumers choose that option, as well as potentially offering it via a monthly subscription.

Hummell isn’t the only one that values Tesla software highly. Morgan Stanley analyst Adam Jonas has taken a sum-of-the-parts approach to valuing Tesla stock, looking at the different businesses separately. He values Tesla’s software and services business at roughly $250 billion.

That’s lower than Hummell’s call, but Jonas still rates Tesla stock at Buy, with a target of $880 for the share price. Jonas believes the Tesla car business is more valuable than Hummell does, valuing it at roughly $350 billion.

All the value and profit coming from software isn’t just a benefit to Tesla. Other auto makers plan similar products.

Ford Motor

(F) already plans to offer products related to its fleet of commercial vehicles around the globe.

General Motors

(GM) still has On Star. And Tesla peer

NIO

(NIO) is considering the idea of selling its autonomous-driving software as a subscription.

The theoretical valuation discussions about hidden assets, however, weren’t helping Tesla stock Wednesday. Shares were down about 0.6% in midday trading. in line with the

S&P 500.

The

Dow Jones Industrial Average

was up about 0.1%.

The stock is down about 15% over the past couple of weeks, but is still more than 350% higher over the past year.

Write to Al Root at [email protected]

More Stories

Best Carry-On Luggage: Your Ultimate Travel Companion

How the P10 Mask Enhances Your CPAP Experience

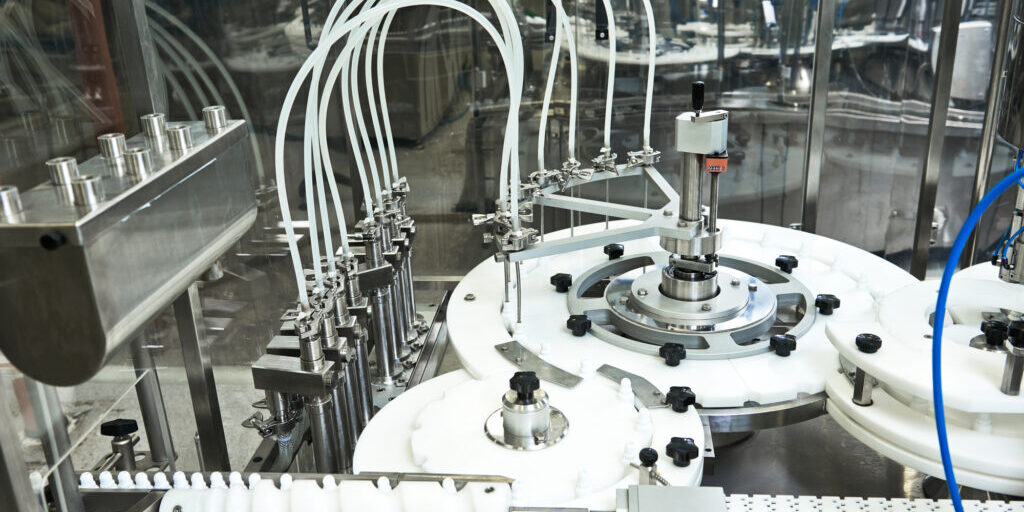

Evaluating the Efficiency of Different Liquid Filling Machine Manufacturers