Unity Software (NYSE:U) had its price target dropped by equities researchers at Oppenheimer from $185.00 to $135.00 in a report released on Friday, The Fly reports. Oppenheimer’s target price points to a potential upside of 24.24% from the company’s previous close.

Other analysts have also issued reports about the company. Wedbush lifted their price objective on Unity Software from $129.00 to $175.00 and gave the stock an “outperform” rating in a research report on Thursday, November 4th. BTIG Research upgraded Unity Software from a “neutral” rating to a “buy” rating and lifted their price objective for the stock from $116.00 to $171.00 in a research report on Monday, January 10th. Barclays lifted their price objective on Unity Software from $105.00 to $162.00 and gave the stock an “equal weight” rating in a research report on Wednesday, November 10th. Piper Sandler lifted their price objective on Unity Software from $152.00 to $180.00 and gave the stock an “overweight” rating in a research report on Wednesday, November 10th. Finally, Credit Suisse Group lifted their price objective on Unity Software from $160.00 to $185.00 and gave the stock an “outperform” rating in a research report on Wednesday, November 10th. Two equities research analysts have rated the stock with a hold rating and ten have issued a buy rating to the company. Based on data from MarketBeat, the company presently has an average rating of “Buy” and a consensus price target of $158.45.

Unity Software stock opened at $108.66 on Friday. The stock has a 50-day simple moving average of $129.96 and a 200 day simple moving average of $135.07. Unity Software has a 12-month low of $76.00 and a 12-month high of $210.00. The stock has a market capitalization of $31.08 billion, a price-to-earnings ratio of -66.26 and a beta of 2.31.

Unity Software (NYSE:U) last released its quarterly earnings results on Thursday, February 3rd. The company reported ($0.05) earnings per share (EPS) for the quarter, beating the Zacks’ consensus estimate of ($0.38) by $0.33. Unity Software had a negative return on equity of 19.10% and a negative net margin of 44.77%. During the same period in the previous year, the business earned ($0.28) earnings per share. Equities analysts predict that Unity Software will post -1.37 EPS for the current fiscal year.

In other Unity Software news, SVP Marc Whitten sold 1,558 shares of the business’s stock in a transaction that occurred on Monday, January 3rd. The stock was sold at an average price of $144.50, for a total value of $225,131.00. The transaction was disclosed in a legal filing with the SEC, which is available at this hyperlink. Also, SVP Ingrid Lestiyo sold 15,000 shares of the business’s stock in a transaction that occurred on Friday, November 12th. The shares were sold at an average price of $8.95, for a total value of $134,250.00. The disclosure for this sale can be found here. Insiders have sold a total of 1,577,956 shares of company stock worth $277,713,682 in the last quarter. 19.00% of the stock is currently owned by company insiders.

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in U. Shell Asset Management Co. bought a new stake in shares of Unity Software during the 2nd quarter worth approximately $25,000. Parkside Financial Bank & Trust raised its stake in shares of Unity Software by 6,700.0% during the 3rd quarter. Parkside Financial Bank & Trust now owns 204 shares of the company’s stock worth $26,000 after purchasing an additional 201 shares in the last quarter. Liberty Wealth Management LLC raised its stake in shares of Unity Software by 376.7% during the 3rd quarter. Liberty Wealth Management LLC now owns 205 shares of the company’s stock worth $32,000 after purchasing an additional 162 shares in the last quarter. Ellevest Inc. raised its stake in shares of Unity Software by 276.7% during the 4th quarter. Ellevest Inc. now owns 226 shares of the company’s stock worth $32,000 after purchasing an additional 166 shares in the last quarter. Finally, FORA Capital LLC bought a new stake in shares of Unity Software during the 2nd quarter worth approximately $47,000. Hedge funds and other institutional investors own 77.43% of the company’s stock.

About Unity Software

Unity Software Inc operates a real-time 3D development platform. Its platform provides software solutions to create, run, and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. The company offers its solutions directly through its online store and field sales operations in North America, Denmark, Finland, the United Kingdom, Germany, Japan, China, Singapore, and South Korea, as well as indirectly through independent distributors and resellers worldwide.

Featured Stories

Want More Great Investing Ideas?

More Stories

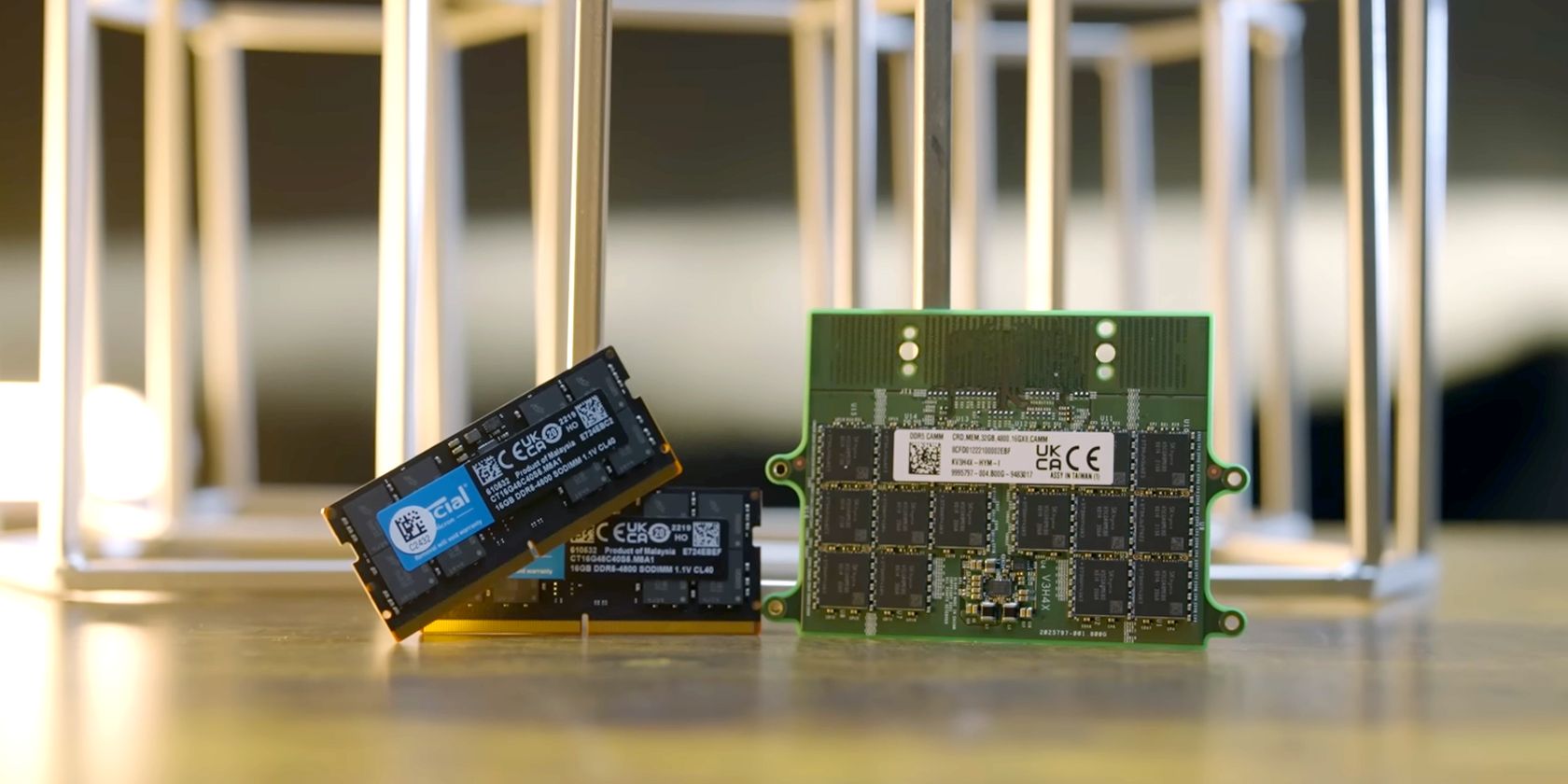

CAMM Memory vs DDR5: What’s the Difference?

The Evolution of Retail Real Estate in Florida: Opportunities in Port Orange and Tampa

Everything You Need to Know About CAMM Memory Modules