The trouble with never is that it’s a mighty long time. But just as Warren Buffett claims that he will never sell a share of Coca-Cola, I don’t foresee a day where I will ever sell my shares of Amazon ( AMZN 2.55% ) or Apple ( AAPL 2.09% ).

There will be times when a little profit-taking will look opportunistic, but for a long-term investor patience pays off by buying and holding great companies without trying to time the market. Both of these titans are leaders and innovators that make a great case to hold forever.

Image Source: Amazon

The case for Amazon

For the last two years, Amazon has seen its full-year e-commerce sales grow by 16.7% and 15% year over year, respectively, growing to $468 billion in e-commerce sales in 2021. This was partially helped along by a pandemic that led to keeping many people home and moving more purchases online. However, although year-over-year sales continue to increase at a double-digit rate, it might be alarming to some investors that since 2018 the year-over-year sales growth rate has decreased each year, dropping from 18.7% in 2018. But at the same time, with revenue growth like Amazon’s, it’s increasingly difficult for a company to keep up that year-over-year growth rate consistently.

What might be a bit concerning to Amazon’s investors is that top online retail competitor Walmart saw year-over-year online sales increase 58% and 63% the last two years. But Amazon investors shouldn’t have too much to worry about as the company continues its reign as the world’s leading online marketplace by revenue and market cap, and doesn’t appear to be losing that title anytime soon.

What’s more, Amazon is experiencing a shift in which its higher margin generator is also likely to be its lead revenue generator in the future. Amazon Web Services (AWS) is why Amazon crushed the fourth-quarter operating income estimate, generating operating profit of $5.3 billion in Q4, an increase of 49% year over year for the quarter, and its largest quarter-over-quarter revenue growth ever, resulting in $71 billion for full year 2021. In fact, the average full-year year-over-year growth of AWS for the past four years is 42.6% compared to the company’s average online retail growth rate of 17% for the same time period. If both growth rates hold steady through the remainder of the decade, AWS could overtake retail in total revenue by 2030. And both segments could top the $1 trillion mark before the end of the decade.

It should also benefit investors to know that Amazon recently provided news of a $10 billion stock buyback plan, signaling management’s belief that the company stock is worth a premium to its current price. And on top of that, it announced the company’s first stock split in over 20 years, which will provide 20 shares of stock for every one share owned by investors of record as of May 27.

The case for Apple

Apple’s big historical revenue boost moment came at the launch of a revolutionary global product — the iPhone. The company’s worth and its products are just two of the many reasons to buy Apple stock and never sell. But like Amazon, the company’s lead revenue generator of the future could be its services segment encompassing Apple Music, software, and services, which brought in $68 billion in 2021. That number reflects a streak of six straight quarters, and 20 of the past 23 seeing sequential quarterly increases in services revenue.

Services are responsible for 18% of Apple’s total annual revenue, which is a distant second to iPhones at 52%, but since 2015 it is capturing a larger percentage of the total, as the iPhone segment is showing a shrinking portion of total. At these rates it’s not likely to overtake the iPhone as a percentage of total revenue by 2030, but an eventual shift to the higher-margin segment as the lead revenue generator is on course.

The great news for investors is that iPhone sales have continued to increase in unit volume, and global market share has remained steady since the first quarter of 2020, culminating in a 22% market share in the fourth quarter of 2021 — its highest rate in the past two years. Along with iPhone sales will come additional sales in services such as AppleCare. But in years where iPhone sales may drop off, services can continue to grow as a result of the 1.65 billion active installed Apple devices, and over 1 billion active iPhones worldwide.

Perhaps the biggest moment has yet to take place for Apple. Its next “iPhone moment” may take place in the form of a revolutionary mode of transportation. The iCar, or Apple Car, has been rumored for a few years. And after watching other companies such as Tesla set the pace for electric and autonomous vehicles, Apple can benefit from learning from the successes and failures of its predecessors in this space.

Working toward a potential 2025 launch date, the company has been testing its autonomous navigation software since 2017, and the project is considered the mother of all artificial intelligence projects by CEO Tim Cook. As if Apple didn’t already provide enough reason to invest in the company forever, I’ll gladly hold on to it for when the time comes to release its next game-changing product.

This article represents the opinion of the writer, who may disagree with the “official” recommendation position of a Motley Fool premium advisory service. We’re motley! Questioning an investing thesis – even one of our own – helps us all think critically about investing and make decisions that help us become smarter, happier, and richer.

More Stories

Best Carry-On Luggage: Your Ultimate Travel Companion

How the P10 Mask Enhances Your CPAP Experience

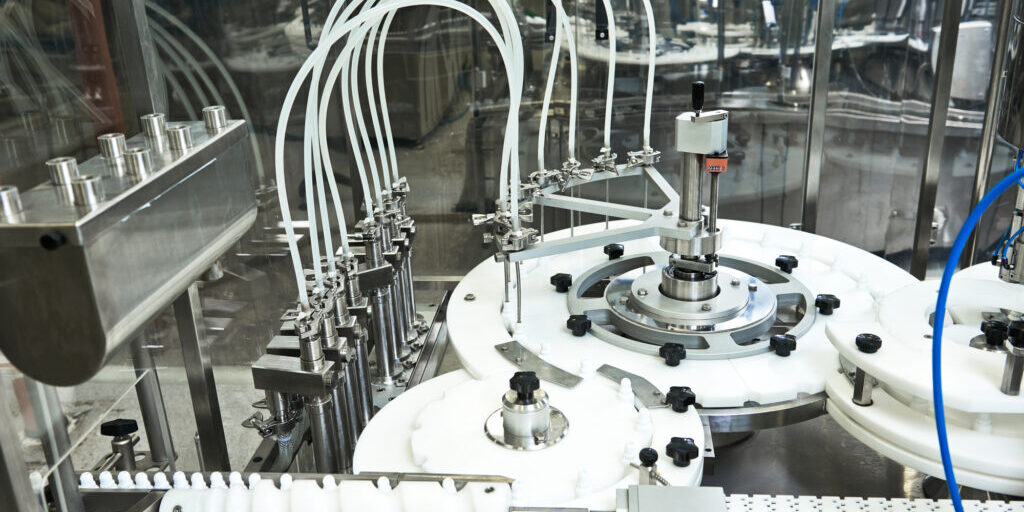

Evaluating the Efficiency of Different Liquid Filling Machine Manufacturers