Critics of ID.me worry about a private company collecting biometric data on millions of Americans.

ID.me

The IRS uses ID.me — a third-party service with a thorough registration process that includes uploading a “video selfie” through ID.me’s facial recognition software — to manage new signups for the agency’s online tax services.

Soon, everyone who wants to use IRS services online — including viewing and making payments online, updating a mailing address, and accessing the Child Tax Credit Update Portal — will need to register through ID.me.

Though older IRS accounts still work, starting this summer everyone will need to complete ID.me verification. According to a November 2021 announcement, all online IRS accounts will be required to transition to ID.me in “summer 2022.”

“Identity verification is critical to protect taxpayers and their information,” IRS Commissioner Chuck Rettig said in the release. “The IRS has been working hard to make improvements in this area, and this new verification process is designed to make IRS online applications as secure as possible for people.”

Critics of ID.me worry about a private company collecting biometric data on millions of Americans, as well as racial and gender biases in the proprietary facial recognition technology. On Friday, Bloomberg reported that the IRS is “reconsidering” its relationship with ID.me in light of the concerns about facial recognition.

We’ll explain how the ID.me signup works, how secure it is and how to take your video selfie, as well as what to do if ID.me fails to verify your identity.

For more, learn when to file your taxes, how to choose the best tax-prep software for 2022 and how you could get a bigger tax refund this year due to the expanded child care tax credit.

Why do I need to create an ID.me account?

Creating an ID.me account with the IRS provides several benefits — you can make or schedule payments, view and print tax records and manage online authorization requests from tax professionals. The ID.me IRS account was primarily used in 2021 by recipients of advance child tax credit payments, who could use it to enroll or unenroll in the advance payment program and to monitor their payments.

An ID.me account is currently required to create a new online IRS account. If you have an IRS account name and password that you created before ID.me was implemented, that account will still work until summer 2022. The IRS has not given a specific date for when the old accounts must be converted over to ID.me accounts.

The IRS was originally using ID.me verification solely for its child tax credit tools but has since expanded its online services to include viewing and printing online transcripts, making tax payments and applying for payment plans, monitoring Economic Impact Payments like stimulus checks and requesting Identity Protection PINs.

By the end of this year, the agency expects an ID.me-verified account will be needed to access most areas of your online IRS account.

Is the ID.me facial-recognition program secure?

On Monday, ID.me issued a statement saying it was dedicated to consumer privacy and reiterated that it does not sell users’ biometrics or personal information.

“We are committed to ensuring everyone can verify their identity online and use it to access essential services,” ID.me founder Blake Hall said in the release. “Our 1:1 face match is comparable to taking a selfie to unlock a smartphone. ID.me does not use 1:many facial recognition, which is more complex and problematic.”

But critics say the government is making an outside company the gatekeeper of critical and highly confidential information.

“This announcement signals one of the largest expansions of facial recognition technology in the U.S. and there is no question that it will harm peoples’ privacy,” Caitlin Seeley George, campaign director at Fight For the Future, told Axios.

While ID.me doesn’t sell personal info to other corporations, it does retain the right to share it with the police and other government agencies.

There are also concerns the system often misidentifies women, people of color and gender-nonconforming individuals — and that the need for a smartphone or webcam-enabled computer creates undue hurdles for economically disadvantaged Americans, seniors and other groups. According to Seeley George, when ID.me was used for state unemployment benefits, people had problems with the system.

In the release, Hall said ID.me’s research found no disparity based on skin color and, as part of the company’s “No Identity Left Behind” initiative, video-chat agents are available as a backup. There are more than 650 in-person identity verification locations throughout the US, with agents fluent in more than a dozen languages.

“When using an ID.me Login, users can trust that they remain in control over their personal information,” he said, “and have assurance against the improper or fraudulent use of their personal information being used to access any affiliated sites.”

An ID.me “Privacy Bill of Rights” is available on the company’s website.

How do I sign up for an ID.me account?

Before you get started with ID.me, you’ll need the following:

- Your Social Security number (you do not need the physical card)

- A driver’s license, US passport, or US passport card

- A smartphone or computer with a camera

Online filers will need to set up their ID.me IRS account with a video selfie by summer 2022.

Dan Avery/CNET

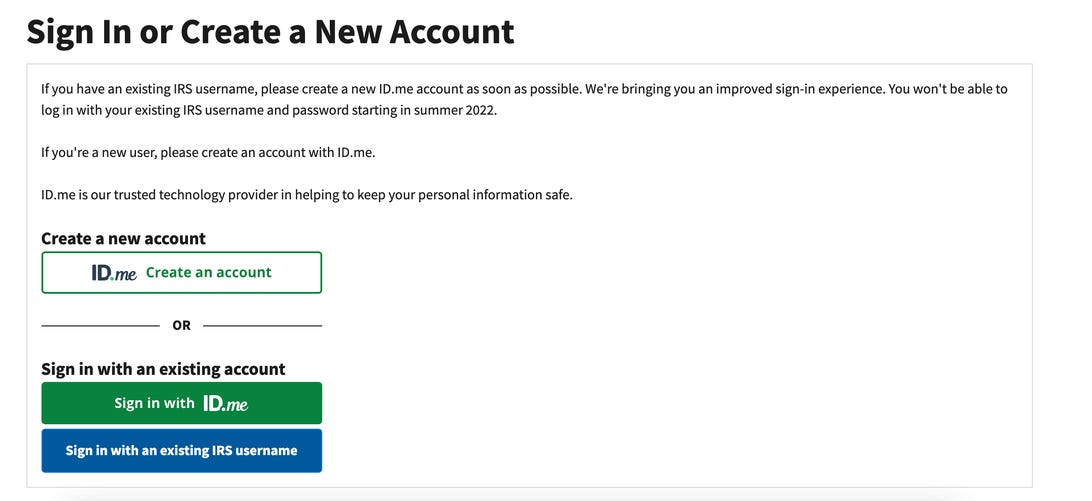

1. Visit the “Your Online Account” page on the IRS website and click the button marked Sign into your online account. You’ll be given the option of creating a new ID.me account or signing in to an existing account. Click the white ID.me Create an account button to start the registration process.

2. Next, enter your email address and choose a strong password. ID.me requires that passwords be eight characters or longer with at least one capital letter, one lowercase letter and a number. Confirm your password, click the check box to accept ID.me’s terms and conditions and then click Create account.

3. ID.me will then send you a message to confirm your email address. Check your inbox for an email from ID.me, then click on the blue Confirm your email button in the message. Return to your browser.

4. Next you’ll need to enable multifactor authentication — a second step to prove it’s actually you each time you sign in with your ID.me password. Most people will probably opt for a text message or phone call to their mobile phones. After selecting your MFA option, enter the six-digit code sent to you by ID.me and click Continue. You’ll need to use this step every time you log in to your online IRS account.

5. Now you’ll need to add pictures of your photo ID. You can upload photos or take pictures with your phone. You’ll need to choose one of three acceptable ID options: US passport book, state driver’s license, or US passport card. Upload pictures of both the front and back of your driver’s license or passport. If you’d like to take new pictures of your document with your phone, enter your phone number and ID.me will send you a link.

6. After uploading your document, you’ll need to take and upload a video selfie with your phone or computer camera. If you want to use your webcam, click the white Take a selfie with my webcam button. If you want to use your phone, click the blue Take a selfie with my phone button and enter your phone number and ID.me will text you a message with a link.

After uploading a copy of your driver’s license, passport or other government-issued identification, you’ll have to take a video selfie to continue registering with ID.me.

Patrick Holland/CNET

7. When taking your video selfie, be sure to position your phone in portrait mode and move your head very close to the camera. The background will flash different colors as it scans your face. When you see a green checkmark, your video selfie is complete. Click Continue and return to your original browser window.

8. Next confirm your Social Security number by entering it and clicking Continue.

9. ID.me will now present a summary of your personal information, including name, address and phone number. Confirm that everything is correct, check the “Fair Credit Reporting Act” check box and click Continue.

10. After confirming your identity, ID.me will send you a text message asking you to explicitly allow the IRS access. Although you won’t need to register with ID.me again, you will need to “allow” every service you want to use it with, such as Social Security or VA.

11. Click Allow and continue on the ID.me message to send verification to the IRS.

12. Your IRS online account is now complete and active. The IRS logs you out of your account fairly quickly, so you’ll likely need to visit the Your Online Account page to log in (with MFA) each time you want to use your IRS online account.

What if I have problems verifying my identity with ID.me?

In 2021, cases of people unable to complete verification with ID.me while trying to access their unemployment benefits made headlines, with politicians blaming errors in the company’s facial-recognition software for lengthy delays in delivering checks.

If ID.me can’t verify your identification through its standard registration process, it will refer your case to a “Trusted Referee,” a live person who will review your application online via video call. The video call will require a bit more documentation — either two primary identification documents or one primary document and two supplementary documents. The full list of acceptable documentation can be found on the ID.me website.

Early last year, the wait for a video call with Trusted Referees was reported to be anywhere from 3 to 6 hours, and sometimes up to multiple days. But by August 2021, ID.me CEO Blake Hall claimed that waiting times “have been consistently under 30 minutes for the past month and are currently in the single digits.”

Hall blamed the delays on states sending ID.me massive case backlogs all at once.

A number of users have reported an error code 2001 after completing the process to create an online IRS account, with the message, “A condition has been identified that’s preventing your access to this service.” Some report that the issue resolved with time, and the IRS has addressed the question on its website:

After verifying your identity, you may see an IRS message saying that “A condition has been identified that’s preventing your access to this service.” If you see this message, please try to sign in again later.

If you continuously receive this message, this means that you won’t be able to use the online service. Select the “view your alternatives” button on the error page to learn about alternatives for completing your transaction.

What else is ID.me used for?

ID.me is an “identity-proofing” company launched in 2010 to support the US military in verifying the identity of service members. It was approved by the federal government as a “credential service provider” in 2014 and has since been used by a number of government agencies — the IRS launched a pilot program for ID.me in 2017 and has expanded the service greatly since.

Along with verifying identity for the IRS, ID.me is used by 27 states to access unemployment benefits and other programs, more than 500 retailers and federal agencies such as Social Security and Veterans’ Affairs.

Once you have confirmed your identity with ID.me, you will have access to all of the state and federal online services that use it.

States Current Using ID.me Verification

| Arizona | California | Colorado | Delaware | Florida |

|---|---|---|---|---|

| Georgia | Idaho | Indiana | Kentucky | Louisiana |

| Maine | Massachusetts | Mississippi | Missouri | Montana |

| Nevada | New Jersey | New York | North Carolina | North Dakota |

| Oregon | Pennsylvania | South Carolina | Texas | Virginia |

| Washington | Wyoming |