[ad_1]

Jetlinerimages/iStock Unreleased through Getty Pictures

Thesis

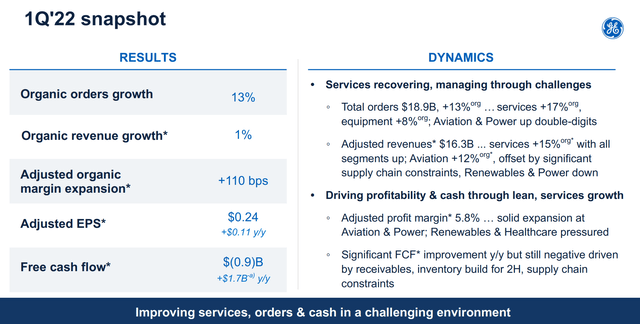

Common Electric powered (NYSE:GE) documented mixed outcomes for Q1 2022. On the favourable aspect, total orders described a solid 13% expansion, and organic and natural earnings also grew by 1% amid provide improve disruptions, travel recovery, and COVID lockdown in China. Its aviation phase is the bright location. Both equally civilian and army product sales are strong. Armed service revenue need to be a major-line driver likely forward, versus the backdrop of protection spending plan will increase close to the world and its progress to source its XA100 adaptive cycle motor to equally the F-35A and F-35C jet fighters.

On the destructive facet, free money move was still an outflow of $.9B, the credit card debt degree is still large, and a lot of macroeconomic challenges will be quite most likely to persist into the upcoming. The pending 3-way break up provides further uncertainties. Ultimately, the latest valuation delivers no obvious margin of safety. My closing verdict is a keep score thinking of these uncertainties.

Q1 2022 Combined Final results

GE claimed mixed effects for Q1 2022. On the positive side, complete orders came in at $18.9B, a reliable 13% development YoY. And organic revenue also grew somewhat by 1%. Its Aviation and Electricity segments are the brilliant places and noted double-digit development (a lot more on aviation in the upcoming segment). Having said that, on the unfavorable aspect, absolutely free hard cash move (“FCF”) is even now in the negative (an outflow of $.9B). Whilst it is an improvement of $1.7B from a calendar year ago, also notice that the FCF advancement was just after modifying discontinued factoring and credit card debt reduction steps.

On the lookout forward, a lot of of the problems that plagued GE in the past quarters will pretty likely persist, these kinds of as supply-chain issues, Russia / Ukraine war, and inflation. These factors push its FY 2022 outlook in the direction of the low-stop vary it introduced previously this 12 months. As CEO Larry Culp commented during the earnings report (abridged and emphases additional by me).

I’m very pleased of how our staff drove improved services, orders and cash as we managed by rising difficulties in the 1st quarter. Orders have been up 13% organically, with toughness in both of those services and equipment, and we noticed double-digit development in Aviation and Power. Profits was up marginally, pushed by advancement in increased-margin services in all segments. We saw continued momentum at Aviation with income up double digits. This on the other hand was mostly offset by source chain constraints in all segments, specially Wellness Care and Aviation, U.S. coverage uncertainty driving reduced Onshore Wind North American deliveries at Renewables this quarter and continued selectivity at Electric power.

GE 2022 Q1 earnings report

Aviation Is A Brilliant Place

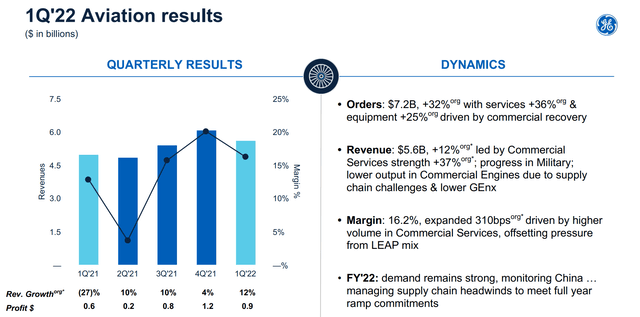

As the CEO commented, Aviation is indeed the bright place. And aviation is also the phase that will carry the GE title and symbol immediately after the 3-way break up, as to be in-depth following. Both equally civilian and military product sales are sturdy. Especially, navy gross sales should really be a major-line driver going ahead versus the backdrop of a heightened perception of countrywide security close to the world. The aviation segment started its hottest take a look at marketing campaign of the XA100 adaptive cycle motor, intended to in shape both of those the F-35A and F-35C jet fighters.

The business flight side also saw an upward trajectory. GE aviation boasts the youngest and major industrial fleet and the most diversified solutions portfolio in its heritage. In actuality, about half of the company’s engines employed on well known Airbus and Boeing versions have not but been in for their initial shop pay a visit to. For this reason, there are great factors to anticipate robust need for forthcoming shop visits and aftermarket services. And shop visits and aftermarket providers are also some of the most significant-margin revenues. For instance, its Q1 effects described the margin in the aviation section reaching 16.2%, a 310 bps enlargement. And it attributed the expansion largely driven by greater volume in commercial services (with some offsetting force from the LEAP mixes, although).

As CEO Larry Culp commented all through the Bernstein 38th Annual Strategic Decisions Convention soon immediately after Q1 earning, GE aviation has shaped and will keep on to form the upcoming of flight. I used a fantastic portion of my experienced career in aerospace and aviation, and I are likely to concur. Even though, Culp reminded the audience that GE sits on the “cusp of a write-up-pandemic recovery”, and a whole lot is dependent on if/when the significant airframers can ramp from listed here.

I assume if you simplify the GE tale these days, it only comes down to three management companies well positioned to take edge of what we see as a considerable expansion runway in Aviation, Healthcare and in Electrical power. Evidently, our Aviation organization will form the long run of flight, generally has and we’re committed to doing that over the medium to lengthy term. But here, we sit truly on the cusp of a article-pandemic recovery, both in utilization of the existing fleet. And as our major airframers preparing to ramp from listed here.

GE 2022 Q1 earnings report

3-way Split Adds Additional Uncertainty

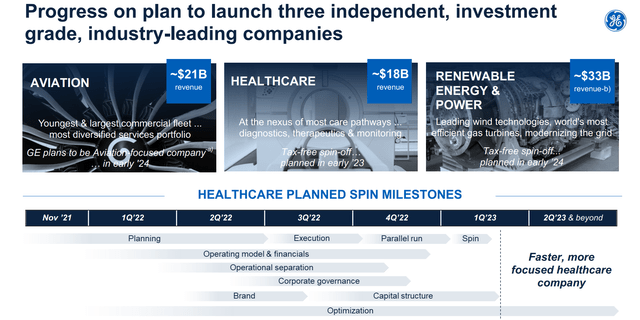

GE declared its program to split into a few different firms again in Nov 2021. As CEO Larry Culp said in the announcement,

By creating three business-major, world wide public companies, just about every can advantage from bigger target, customized money allocation, and strategic overall flexibility to travel extended-term growth and price for buyers, investors and staff.

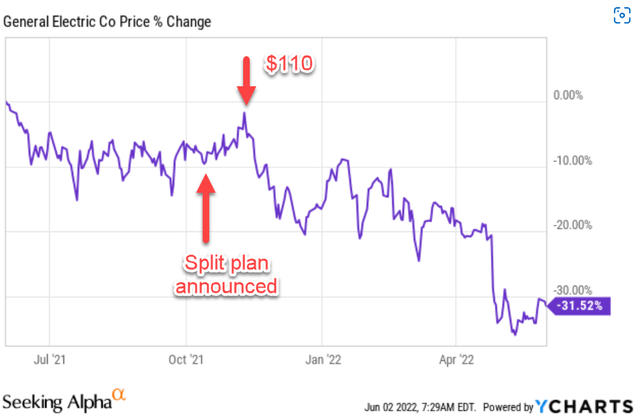

The market responses had been indeed optimistic, at least to begin with, as you can see from the adhering to chart. Its share prices rallied by just about 17% in premarket immediately after the announcement and climbed to a peak in close proximity to $110 in the investing days shortly afterward.

On the other hand, the optimism was short-lived. A slew of damaging macroeconomic growth began to transpire shortly afterward. Initially, the Russia/Ukraine war broke up. Then inflation commenced to operate absent, and the Fed commenced its program to dramatically tighten momentary materials. At the very same time, the global offer chain disruptions persisted lengthier than antedated and even worsened presented the China lockdown and the ripple effects of the Russian/Ukraine war. All explained to, the inventory cost fell about 30% from its peak and is back again to the $70 to $75 level.

Searching forward, GE nonetheless maintains it 3-way break up prepare and the timetable it introduced before. Especially, the break up is scheduled to commence in 2023 when the health care business enterprise will become an impartial corporation very first. Then someday in 2024, the vitality and power unit will be spun off, leaving the remaining aviation phase as a standalone entity and carrying on the GE name and symbol.

I did not share the market’s original optimism about the break up-off then, and I even now do not share it now. To me, this sort of a complicated spinoff only adds uncertainties for both of those existing and opportunity investors. And the advantages of the spinoff, if they do materialize as hypothesized, won’t get started to come in decades right after the spin has been accomplished.

Trying to find Alpha

GE 2022 Q1 earnings report

Valuation

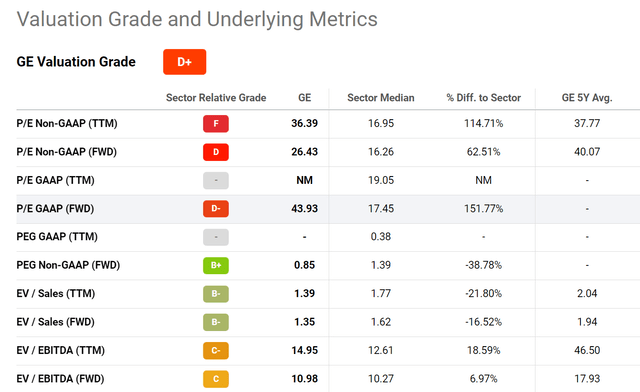

In conditions of valuation, GE is at present not at an clear price cut, as you can see from the pursuing desk. General, it is investing at an elevated PE (in the selection from 26x to 44x, depending on which metric you select). The valuation will be bigger than what is revealed here as soon as its relatively large credit card debt is factored in. And the pending spinoff adds additional troubles and uncertainties to the valuation. I do not see a obvious margin of safety at these price ranges.

Looking for Alpha

Closing Views And Other Dangers

To me, financial investment in GE faces far too numerous uncertainties as outlined above, each unfamiliar and unknowable. Nonetheless, I do not see a crystal clear valuation discounted and a apparent margin of basic safety, which is the core rationale for my keeping score.

Aside from the hazards talked about over, the sanction guidelines regarding Russia can build damaging outcomes on GE’s profits, primarily for its aviation and electricity corporations. Growing inflation and labor price tag also produces force on its margins. Its CEO Culp has announced options (such as price tag hikes) to overcome the problem and continue to keep charges less than regulate. It remains unsure if these programs can be powerful.

[ad_2]

Resource website link