[ad_1]

UMB Fiscal Corporation’s UMBF subsidiary has signed a definitive settlement to obtain the wellness personal savings account (HSA) business of Previous Countrywide Lender, a wholly-owned subsidiary of Previous National Bancorp ONB.

The transaction entails the transfer of about $500 million in consumer assets. Of this, approximately $400 million are held in deposit accounts (as of Mar 31, 2022) by way of 157,000 accounts across far more than 3,000 employer groups. That’s why, with the acquisition, UMBF will be ready to drastically extend its direct-to-employer accounts and enrich earnings-building abilities.

The buyout is pending regulatory approvals and is expected to shut in fourth-quarter 2022.

UMBF management noted, “This acquisition supplies considerable business acquire and a potent, skilled team that will complement our organic and natural expansion efforts.”

The acquisition will also support UMBF to leverage Old National Bancorp’s abilities in the HAS place, as the latter is one of the major financial institution holding firms headquartered in the Midwest, and has made available direct-to-employer HSAs since 2004.

“While we have been in the HSA area considering that the beginning, we have been really intentional in continuing to increase and evolve our organization design and services dependent on customer requirements, marketplace adjustments, and an ever-modifying health care landscape,” UMBF management commented.

Markedly, UMB Economical has been targeted on diversifying operations to non-curiosity resources of revenues in order to lessen exposure to desire prices to balance the unparalleled pitfalls linked to the charge natural environment. While cost money witnessed a decrease in 2021, the similar observed a compounded yearly growth fee (CAGR) of 5.2% for the 4-calendar year period of time ended 2021. In to start with quarter 2022, the metric witnessed an growing pattern.

Also, the company’s investment decision in revenue-generating abilities is possible to assist advancement. Heading ahead, revenues from varied lines of enterprise and verticals will hold aiding UMB Economical to provide a all-natural hedge versus lower price environments.

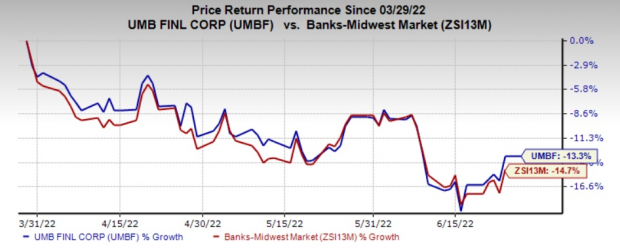

Above the earlier 3 months, shares of UMBF have shed 13.3% when compared with the industry’s decrease of 14.7%.

Impression Source: Zacks Financial investment Investigate

Currently, UMBF carries a Zacks Rank #3 (Maintain). You can see the total checklist of today’s Zacks #1 Rank (Powerful Buy) shares below.

Inorganic Expansion Endeavours by Other Financial institutions

To start with Bancorp FBNC announced that it signed a definitive merger agreement to obtain GrandSouth Bancorporation in an all-inventory transaction. The offer is valued at $181.1 million or $31.43 per share, primarily based on FBNC’s inventory selling price as of Jun 17, 2022.

At closing, shareholders of GrandSouth will receive .910 shares of FBNC’s prevalent inventory for each and every share of GrandSouth’s popular and most popular inventory they personal.

Offered GrandSouth’s footprint of 8 branches in South Carolina, the acquisition permits To start with Bancorp to scale in its targeted markets, together with Greenville, Fountain Inn, Anderson, Greer, Columbia, Orangeburg and Charleston. With a concentrate on compact small business banking, the acquisition enhances To start with Bank’s strengths in that location.

F.N.B. Corp FNB signed an settlement to acquire Greenville-dependent UB Bancorp to bolster its presence in North Carolina. The all-inventory offer is valued at $19.56 per share or just about $117 million, based mostly on the closing inventory rate of FNB as of May perhaps 31, 2022.

Adhering to the offer completion, anticipated in the previous quarter of 2022, F.N.B. Corp will probable move to the eighth position in North Carolina in terms of deposit marketplace share. Also, the expense of deposits of 11 foundation factors will be accretive to the company’s financials in a climbing charge surroundings.

5 Shares Established to Double

Every was handpicked by a Zacks specialist as the #1 favourite stock to get +100% or much more in 2021. Earlier tips have soared +143.%, +175.9%, +498.3% and +673.%.

Most of the shares in this report are flying below Wall Road radar, which gives a wonderful prospect to get in on the floor ground.

Today, See These 5 Likely House Runs >>

Click on to get this absolutely free report

UMB Money Corporation (UMBF): Cost-free Inventory Examination Report

F.N.B. Corporation (FNB): Totally free Inventory Analysis Report

Outdated National Bancorp (ONB): No cost Stock Assessment Report

To start with Bancorp (FBNC): Free Inventory Investigation Report

To go through this article on Zacks.com simply click in this article.

The views and views expressed herein are the sights and viewpoints of the author and do not necessarily reflect those people of Nasdaq, Inc.

[ad_2]

Source website link