Getting ready to file your tax return? Find out which credit card will save you money on tax filing service fees.

As April 15 quickly approaches, it’s time to begin thinking about filing your taxes. If you haven’t done this already, we may have a way for you to save money on the cost of tax filing. Most tax preparation software and online programs charge a fee to do this, but you may be able to trim down the price. Keep reading to find out which credit cards to use to save on tax filing service fees.

American Express

If you’re an Amex cardholder, you’ll be able to save money on tax filing service fees. Currently, Amex offers savings for TaxAct and TurboTax.

TaxAct: Earn 30% statement credit on purchases of up to $60. This offer is available when making an online purchase at TaxAct.com by April 15, 2021.

TurboTax: Cardmembers can save on filing fees for the following software programs:

$10 off Deluxe or Live Deluxe

$15 off Premier or Live Premier

$20 off Self-Employed or Live Self-Employed

This TurboTax offer is available through April 16, 2021.

Capital One

Capital one is offering 10% back in statement credit to some cardmembers who make a purchase at HRBlock.com. This offer can be found in the Capital One Offers on your mobile app or online if available to you.

Chase

Chase cardmembers can also save on tax filing service fees in the form of a statement credit. By using the Chase Offers program, users can earn 10% back on TurboTax purchases. This offer must be activated within Chase Offers, and the maximum statement credit available is $8.

Chase cardholders also get access to the following savings on tax-filing products at TurboTax:

$5 off Deluxe or Live Deluxe

$10 off Premier or Live Premier

$15 off Self-Employed or Live Self-Employed

Citi

Citi cardmembers also have tax filing discounts available. They are able to save on tax filing service fees when using TurboTax. Users who access the discounted program prices will find the following savings:

Save $10 on Deluxe or Live Deluxe

Save $15 on Premier or Live Premier

Save $20 on Self-Employed or Live Self-Employed

Wells Fargo

Wells Fargo cardmembers can also save. There are two ways to save when using TaxAct:

Wells Fargo cardmembers can use Wells Fargo’s rewards site, Earn More Mall, to activate an offer that allows them to earn a bonus 6% cash back or 6 points per $1 on purchases made online at TaxAct.com. This offer is available through March 31, 2021.

Those with a Wells Fargo Propel American Express® card can earn 30% cash back when using their card to make an online purchase at TaxAct.com. This offer is available up to $60 and is valid through April 15, 2021.

The bottom line

In addition to these mentioned discounts, you should check your credit card offers before filing. Some credit cards may provide offers for specific tax preparation services, and these offers may only be available on a short-term basis. Doing this will allow you to maximize your savings potential.

Do you want to save on tax filing service fees while also looking for a new credit card? Browse our top credit cards list, choose a card with excellent perks, and take advantage of the above discounts when filing your taxes.

More Stories

Best Carry-On Luggage: Your Ultimate Travel Companion

How the P10 Mask Enhances Your CPAP Experience

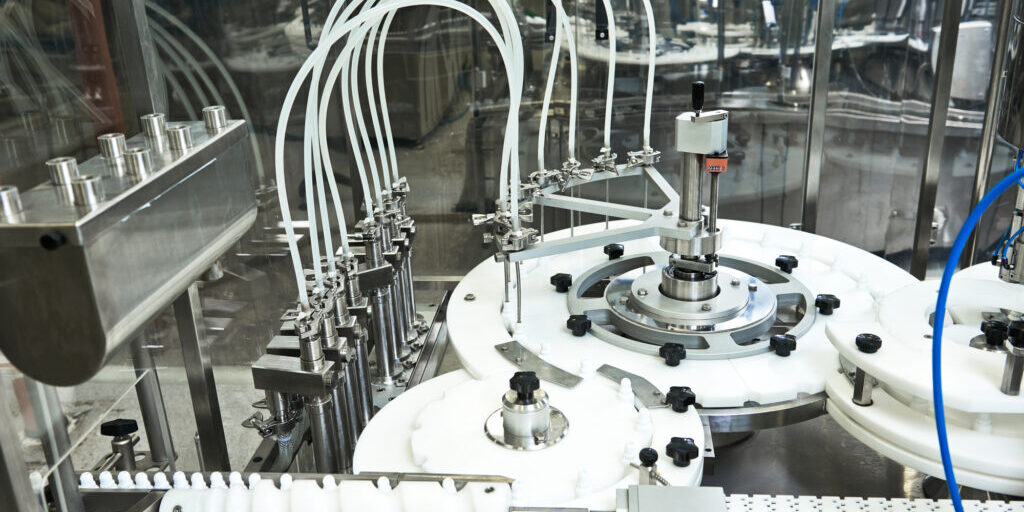

Evaluating the Efficiency of Different Liquid Filling Machine Manufacturers